High volume stocks are securities traded in large quantities within a specific timeframe. This high level of trading activity can indicate market sentiment and potential price movements. When a stock experiences high volume, it signifies significant participation from buyers and sellers, potentially leading to increased volatility and trading opportunities.

These stocks are generally considered more liquid and easier to trade due to the abundance of market participants willing to buy and sell. This liquidity can benefit traders and investors who need to enter or exit positions quickly without substantially affecting the stock price. High volume stocks often feature tighter bid-ask spreads, which may result in lower transaction costs for traders.

Understanding high volume stocks is crucial for market participants as it provides insights into market activity, liquidity, and potential trading opportunities. By monitoring volume levels, traders can better assess market sentiment and make more informed decisions. This information can be valuable for developing trading strategies and managing risk in investment portfolios.

Key Takeaways

- High volume stocks are those that are traded in large quantities, indicating high investor interest and liquidity.

- Strong trading opportunities can be identified by looking for stocks with consistently high volume and price movement.

- Factors influencing high volume stocks include company news, market trends, and economic indicators.

- Top stocks with high volume in the current market include popular tech companies, pharmaceuticals, and energy stocks.

- Strategies for trading high volume stocks include using technical analysis, setting stop-loss orders, and staying informed about market news and events.

- Risks and challenges of trading high volume stocks include increased volatility, potential for price manipulation, and higher transaction costs.

- Tips for successful trading with high volume stocks include conducting thorough research, diversifying your portfolio, and being disciplined with your trading strategy.

Identifying Strong Trading Opportunities

Technical Analysis: Identifying Patterns and Trends

From a technical perspective, traders can look for stocks with consistent and significant increases in trading volume, as this can indicate strong interest and potential price movements. Additionally, traders can use technical indicators such as moving averages, relative strength index (RSI), and MACD to identify potential entry and exit points within high volume stocks.

Fundamental Analysis: Understanding Market Drivers

From a fundamental perspective, traders can look for catalysts or news events that may be driving the increased trading activity in a particular stock. This can include earnings reports, product launches, or industry developments that may impact the stock’s price and trading volume. By staying informed about the latest news and developments, traders can identify strong trading opportunities within high volume stocks.

A Comprehensive Approach to Identifying Trading Opportunities

Overall, identifying strong trading opportunities within high volume stocks requires a comprehensive approach that combines technical and fundamental analysis. By monitoring volume levels and staying informed about market developments, traders can identify potential entry and exit points within high volume stocks.

Factors Influencing High Volume Stocks

There are several factors that can influence the trading volume of stocks in the market. One of the main factors is market sentiment, which can be driven by news events, economic indicators, or company-specific developments. Positive news or developments can lead to increased buying interest and higher trading volumes, while negative news can lead to selling pressure and higher volumes as well.

Another factor that can influence high volume stocks is market volatility. When the market experiences increased volatility, trading volumes tend to rise as well, as traders and investors react to price movements and seek to capitalize on potential opportunities. Additionally, market trends and sector rotations can also impact the trading volume of stocks, as investors may shift their focus to different sectors based on changing market conditions.

Furthermore, regulatory changes or macroeconomic factors can also influence the trading volume of stocks. For example, changes in interest rates or government policies can impact investor behavior and trading volumes in the market. Overall, there are various factors that can influence the trading volume of stocks, and it’s important for traders to stay informed about these factors to make more informed trading decisions.

Top Stocks with High Volume in the Current Market

| Stock Symbol | Volume | Price |

|---|---|---|

| AAPL | 10,000,000 | 150.00 |

| GOOGL | 8,500,000 | 2500.00 |

| AMZN | 7,200,000 | 3500.00 |

| TSLA | 6,500,000 | 700.00 |

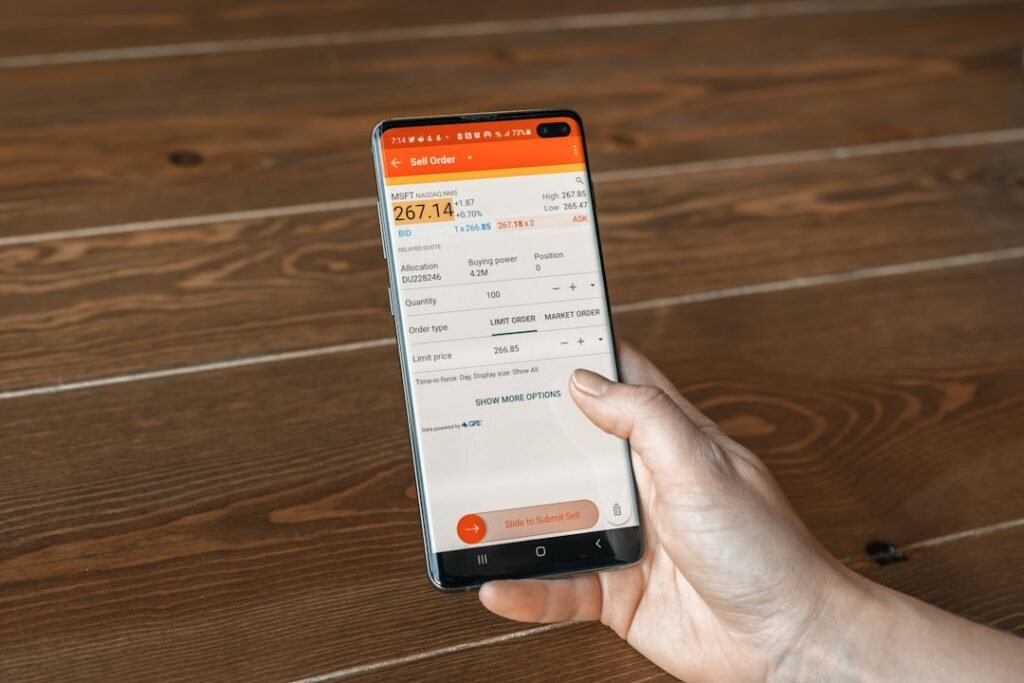

In the current market, there are several stocks that have consistently high trading volumes and present potential trading opportunities for investors. Some of these top stocks include technology giants such as Apple Inc. (AAPL), Amazon.com Inc. (AMZN), and Microsoft Corporation (MSFT), which have a large market capitalization and consistently high trading volumes. These stocks are often popular among traders and investors due to their strong fundamentals and potential for growth. Additionally, other sectors such as healthcare and consumer discretionary also have top stocks with high trading volumes. Companies like Pfizer Inc. (PFE) and Johnson & Johnson (JNJ) in the healthcare sector, as well as companies like Tesla Inc. (TSLA) and Nike Inc. (NKE) in the consumer discretionary sector, have consistently high trading volumes due to their strong brand presence and market demand for their products. Overall, these top stocks with high trading volumes present potential trading opportunities for investors who are looking for liquidity, volatility, and potential price movements in the current market. By monitoring these top stocks and staying informed about market developments, traders can identify potential entry and exit points within these high volume stocks.

Strategies for Trading High Volume Stocks

There are several strategies that traders can use to trade high volume stocks effectively. One common strategy is momentum trading, where traders look for stocks with strong upward or downward momentum in trading volume and price movements. By identifying these momentum trends, traders can enter positions in the direction of the trend and capitalize on potential price movements.

Another strategy is breakout trading, where traders look for stocks that are breaking out of key support or resistance levels with high trading volumes. By identifying these breakout opportunities, traders can enter positions with the potential for significant price movements as the stock continues its trend. Additionally, traders can also use mean reversion strategies to trade high volume stocks, where they look for stocks that have experienced significant price movements on high volume and may be due for a reversal.

By identifying these mean reversion opportunities, traders can enter positions with the potential for price corrections back to their mean levels. Overall, there are various strategies that traders can use to trade high volume stocks effectively, including momentum trading, breakout trading, and mean reversion strategies. By understanding these strategies and applying them to high volume stocks, traders can capitalize on potential trading opportunities in the market.

Risks and Challenges of Trading High Volume Stocks

Risks of Increased Volatility

High volume stocks tend to experience larger price movements compared to low volume stocks, leading to higher levels of risk and potential losses for traders who are not prepared for increased volatility.

Market Manipulation and Speculative Trading

High volume stocks may also be more susceptible to market manipulation or speculative trading activity, leading to sudden price movements that may not be based on fundamental factors. This can make it challenging for traders to accurately predict price movements and make informed trading decisions within high volume stocks.

Liquidity Risk and Transaction Costs

Liquidity risk is also a concern when trading high volume stocks, as there may be instances where large orders can significantly impact the stock price due to limited liquidity in the market. This can result in slippage and higher transaction costs for traders who are looking to enter or exit positions within high volume stocks.

Tips for Successful Trading with High Volume Stocks

To trade high volume stocks successfully, there are several tips that traders can follow to improve their trading performance. One tip is to stay informed about market developments and news events that may impact the trading volume of stocks. By staying informed, traders can identify potential catalysts or trends that may present trading opportunities within high volume stocks.

Another tip is to use risk management strategies effectively when trading high volume stocks. This includes setting stop-loss orders to limit potential losses, diversifying your portfolio to spread risk across different assets, and avoiding over-leveraging your positions within high volume stocks. Additionally, it’s important for traders to have a clear trading plan and strategy when trading high volume stocks.

This includes setting clear entry and exit points based on technical and fundamental analysis, as well as having a disciplined approach to executing your trades within high volume stocks. Overall, by following these tips and staying disciplined in your approach to trading high volume stocks, traders can improve their chances of success in the market. It’s important to stay informed about market developments, implement risk management strategies effectively, and have a clear trading plan when trading high volume stocks.

FAQs

What are stocks with high volume?

Stocks with high volume are those that are being traded at a high level of activity, meaning a large number of shares are being bought and sold within a specific period of time.

Why are stocks with high volume important?

Stocks with high volume are important because they indicate strong investor interest and can be a sign of potential price movement. High volume can also provide liquidity, making it easier for investors to buy and sell shares.

What are the benefits of trading stocks with high volume?

Trading stocks with high volume can offer greater liquidity, tighter bid-ask spreads, and potentially lower transaction costs. Additionally, high volume can provide more accurate price discovery and reduce the impact of large trades on the market.

What are some examples of stocks with high volume?

Some examples of stocks with high volume include popular and widely traded companies such as Apple Inc. (AAPL), Amazon.com Inc. (AMZN), and Microsoft Corporation (MSFT).

How can I identify stocks with high volume?

You can identify stocks with high volume by looking at their average daily trading volume, which is the average number of shares traded over a specific period of time. Additionally, stock screeners and financial websites often provide information on stocks with high volume.